FCFY Free Cash Flow to Equity FCFE per shareMarket Price per share. Working with you to deliver your financial plans for the future.

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

High transparency exclusive deals.

. 120 The cancellations combined with the impact of the government shutdown and. Ad The Only Place Where Private Money Lenders Compete To Fund Your Real Estate Deal. Advanced Emissions Solutions NASDAQ.

The trailing FCF yield for the SP 500 rose from 11 at the end of 2020 to 16 as of 51921 the earliest date 2021 Q1 data was provided by all SP 500 companies. Like typical private equity funds such funds are usually structured as Limited Partnerships. The firms net debt and the value of other claims are then subtracted from.

Free Cash Flow Yield Free Cash Flow Market Capitalization This ratio expresses the percentage of money left over for shareholders compared to the price of the stock. Free cash flow yield is really just the companys free cash flow divided by its market value. Equity free cash-flow yield Equity free cash-flow is the cash generated each year for shareholders after certain non-discretionary expenses have been paid.

Aflac Incorporated has a low debt total debt to equity is only 034 and it has a very low trailing PE of 1009 and a very low forward PE of 1034. The price to economic book value PEBV ratio for COWZ is 14 which is less than the 18 for IUSV holdings. The formula for Terminal value using Free Cash Flow to Equity is FCFF 2022 x 1growth Keg The growth rate is the perpetuity growth of Free Cash Flow to Equity.

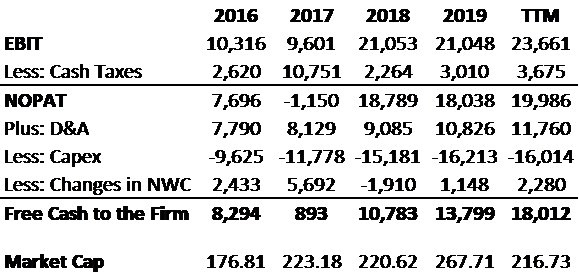

Free Cash Flow to Equity FCFE is the amount of cash generated by a company that can be potentially How to Calculate FCFE from EBITDA How to Calculate FCFE from EBITDA You can. Free Cash Flow yield FCF yield FCF yield is a financial solvency ratio of a company. Free Cash Flow to Equity FCFE Formula Net Income FCFE The calculation of FCFF begins with NOPAT which is a capital-structure neutral metric.

ADES is a small-cap stock 201 million market cap that has a very high dividend yield 928 and an even higher. By Analyst 2 in IB - Ind. Over 250000 Borrowers Private Money Lenders Matched To Date.

Ad Opening up a world of opportunity for you and your business. What is Leveraged Finance. The price to free cash flow.

Ad Help Clients Balance Portfolio Risk Pursue Sustainable Income Before and in Retirement. What Is Free Cash Flow Yield. Cash-on-cash return equity multiple and internal rate of return or IRR.

View past offers and learn more about our unique model. Try It For Free. It equals free cash flow to firm minus after-tax interest expense plus.

The Pacer Global Cash Cows Dividend ETF GCOW uses a free cash flow yield screen and a dividend yield screen to invest in 100 companies from the FTSE Developed Large-Cap Index. Why Private Equity. Over 250000 Borrowers Private Money Lenders Matched To Date.

1 0 Y A F C F 1 0 -Year average free cash flow O S Outstanding shares O Options W Warrants P S P Per. Use Different Types of Growth and Equity-Income Securities to Manage Risks. Click here to see how Fisher Investments delivers clearly better money management.

Learn more and become a Real Estate investor today. When using discounted cash flow analysis 205 of analysts use a residual income approach 351 use a dividend discount model and 869 use a discounted free cash flow model. We have assumed this.

For FCFE however we begin with net. This article examines the practicalities and limitations of three common real estate return metrics. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market.

Ad Deep industry experience unique model. Free cash flow to equity FCFE is the cash flow available for distribution to a companys equity-holders. To break it down free cash flow yield is determined first by using a companys.

1 0 Y A F C F O S O W P S P L C A I where. Try It For Free. The fund manager called General Partner collects money from investors the Limited Partners.

Free Cash Flow and. Ad The Only Place Where Private Money Lenders Compete To Fund Your Real Estate Deal. Free Cash Flow Yield Free Cash Flow Market Capitalization This ratio expresses the percentage of money left over for shareholders compared to the price of the stock.

Get instant access to lessons taught by experienced private equity pros and bulge bracket. From the perspective of common equity holders the free cash flow yield calculation is as follows. 33 billion Free cash flow yield.

283 billion Free cash flow TTM. COWZs free cash flow yield of 4 is double IUSV and SPY at 2. Levered FCF Yield Free Cash Flow to Equity Equity Value Alternatively the levered FCF yield can be calculated as the free cash flow on a per-share basis divided by the current share price.

Ad Were not only legally obligatedweve built our business around putting clients first. If the company has 200 in free cash flow last year the cash yield is 200 divided by 10000 or 20 per 1000 share. Discounting free cash flows to firm FCFF at the weighted average cost of capital WACC yields the enterprise value.

Heres the fun part. Thats 2 the same as the bond.

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

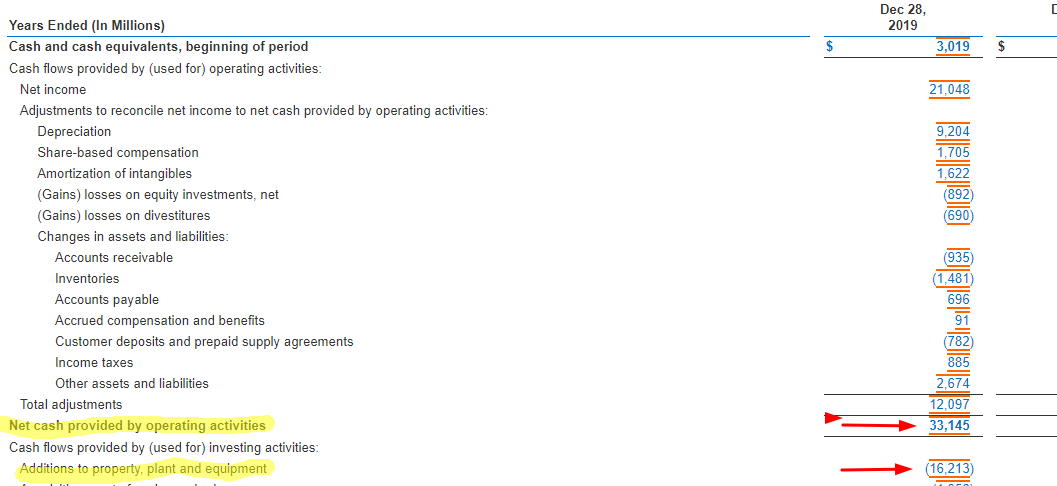

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator

Free Cash Flow Fcf Most Important Metric In Finance Valuation

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator